Payroll calculation: Labor Code, taxes and fees, accrual features. Payroll procedure Payroll calculation and payment procedure

Payroll is a mandatory monthly procedure in every enterprise where employees are registered. This process is inextricably linked with deductions to tax office, respectively, requires high attention and great responsibility.

The procedure for calculating wages

So, let's look at how wages are calculated and other nuances related to it. The main points of this process in our state are regulated by the Labor Code, and the government acts as a guarantor of the relationship between the employer and the employee. This means that careful monitoring and control of the timely calculation of employees and compliance by employers with the terms of payments is carried out. Article 136 of the Labor Code defines the payroll period - twice a calendar month.

In addition to this rule, each individual institution may have its own Regulations on remuneration for the activities of employees, but they cannot change the rights of employees for the worse, in comparison with the criteria approved by the Labor Code. This means that if a company has established an internal regulation on wages issuing wages only once a month, then she breaks the law and can be brought to administrative responsibility. As for certain numbers, they are set by managers at their own discretion, in accordance with labor regulations and collective agreements.

For the most part, companies pay advances and wages to employees, although the Labor Code specifically refers to the payment of salaries twice a month. When we are talking about the advance, it is necessary to clearly stipulate its size and terms of payment, these data must be recorded by an internal local act.

It is worth noting that the amount of the advance, unlike the salary, is fixed, that is, it does not obey either the volume of work performed or the number of hours worked. The amount of the advance is set at the discretion of the company and remains the same from time to time.

Payroll principles

How are wages calculated? When calculating it, you can use any of the two possible options provided for by the Legislation. Each of them has features:

- Payment twice a month. In this case, the documentation for accrual is submitted and processed twice a month, and each time it is necessary to pay contributions to the Pension Fund.

- Charges once a month. In this situation, the salary is also calculated twice a month, but the payment consists of the advance part and the salary after deducting the advance. The first part is not subject to tax deductions.

Documents for payroll

Let's consider on the basis of what documents wages are calculated. The following documents serve as the basis for its formation:

- Employee hiring order. An excerpt from the order is sent to the accounting department, where on the basis of it a personal card of the employee is formed and a personal account is registered. The document on the admission of an employee displays information about the date on which he was hired, the amount of salary, allowances due, and so on. If the order was correctly executed and timely transferred to the accounting department, then the salary will be transferred on time.

- Don't know which document pays wages? The basic data that is required is given in the time sheet and staffing table.

- Contract of employment.

- Documents indicating the amount of work done (with piece-rate calculation).

In addition, there are documents in the presence of which the amount of wages can change both up and down. They include:

- Service notes of various kinds.

- Employee bonus notice.

- Collective agreement.

- Regulation on wages.

Salary and salary

In order to understand how wages are calculated on a salary, it is necessary, first of all, to be able to separate the following two concepts:

- Salary is the amount accrued to an employee by the accounting department for transfer to plastic card. It takes into account all allowances, bonuses, tax and other types of deductions for the established actually worked time period.

- Salary - a small amount paid to an employee as wages, prescribed in the employment agreement, in other words, a zero rate for counting subsequent payments. Given the information on the amount of the salary of the hired employee, all actions for calculating wages are performed on the basis of the approved calculation procedure according to one of the possible systems - piecework or time-based.

Time and piecework pay

Quite often on the network you can find the question: “How are wages calculated in budgetary organizations and private traders”? IN state structures payment system labor activity and the procedure for calculating wages is determined by the Legislation, and in private enterprises - by the founders. But, regardless of the type of organization, payment for labor activity must be made in full accordance with the Labor Code of the Russian Federation. To date, two forms of remuneration have been established:

- Time.

- Piecework.

To eliminate errors and simplify the process of calculating the amount of cash payment due to an employee, a verified formula is used. Wages are calculated for actual hours worked as follows:

- The amount of the salary is divided by the number of working days according to the calendar and multiplied by the number of days actually worked.

- All types of compensation and incentive payments are added to the result obtained.

- Further, income tax and deductions (if necessary) are deducted from the amount received. In accordance with the Legislation, more than 20% of the total income cannot be withheld from wages.

With piecework wages, the company must maintain personal statistics on the production of products. How are wages calculated in this case?

- An indicator of the quantity of products or services produced (in accordance with orders) is taken and multiplied by the established prices.

- Possible compensations and incentive accruals are added to the result obtained, and rewards for going out on holidays and non-working days are added to this amount.

- The percentage of income tax and various deductions (if any) are subtracted from the total amount. If you are interested in how child support is calculated from wages, then this is done just at this step. Alimony is classified as a withholding.

In addition to the basic methods of calculating wages, there are additional ones. In these cases, the formula will slightly differ in its constituent values:

- commission method. When using the calculation option, it is necessary to add percentages of the amount of work performed to the amount of surcharges in the formula.

- chord method. The calculation of wages before withholding income tax and other deductions is carried out on the basis of the listing of work performed and in relation to the established deadlines for completion and the amount of payment.

- How is wages calculated on a variable salary? In this case, the amount of accruals depends on the revenue made for the specified time period.

Director's salary

The director of the organization, just like any other employee, needs to be paid a salary. However, quite often there is an opinion that the director is not paid wages, is this true? In accordance with Article 136 of the Labor Code, all employees of the enterprise, including managers, must be paid twice a month. The minimum wage per month cannot be less than one minimum wage (Article 133 of the Labor Code of the Russian Federation).

You can get around this rule if the director goes on vacation at his own expense. Naturally, this option is suitable for few. Only companies that have temporarily suspended their activities can use it, provided that only the head is on the staff.

Average monthly salary

The calculation of the average monthly salary may be required in the following cases:

- Compensation payments for unused vacation / accrual of vacation pay / calculation upon dismissal.

- Travel allowances.

- Benefits on a sheet of temporary or absolute disability.

- For termination of an employment agreement, reduction of an employee or calculation of severance pay.

- Compensation for downtime due to a force majeure situation or through the fault of the employer.

In addition, the average monthly salary can be calculated at the request of banking institutions, the executive service and other authorized organizations. The average monthly earnings do not include all kinds of remuneration and payments, only what is accrued to the worker in the form of wages, moreover, without tax withheld. So, this amount is not taken into account:

- Help with funerals.

- Child care allowance.

- Compensation due to disability.

- Mother's allowance.

- One-time assistance for medical treatment, vacation, etc.

- Compensation for travel, mobile communications, meals, housing and communal services.

Important! For the correct calculation of the average monthly salary, indicators of the entire last year are taken. The amount of benefits and other payments is subtracted from the result obtained, then this indicator is divided by the number of months that the employee has worked.

Payroll Examples

For example, when calculating the salary of a certain employee, you should use the indicators of all due tax and social payments and information about the labor costs incurred.

So, if for the period established as a time interval for calculating wages, a month lasting, consisting of 21 working days, an employee worked for 20 days with a salary of 15 thousand rubles prescribed in the contract, then in this case, according to the formula for calculating wages for worked time is calculated as follows:

- 15000 x 20/21 = 14285 rubles.

- Let's add to this amount a bonus in the amount of 10% of the salary - 14285 + 1500 = 15785 rubles.

- Next, you should determine the deductions due to the employee - pension, social insurance, mandatory health insurance. These payments are transferred to the funds by the employer.

- We deduct 13% income tax from the salary. Not sure how income tax is calculated on wages? Everything is extremely simple - the amount of the salary is multiplied by the tax rate of 13%. Consider our example: 15785 x 0.13 = 2052.05.

If no other deductions are provided in this case, then the employee's salary will be 15785 - 2052.05 = 13732.95 rubles.

Withholdings and taxes

The difference between the wages prescribed in the employment contract and the wages actually paid is the sum of all possible deductions, which are divided into three groups:

- Mandatory - prescribed by order of the judiciary on the basis of writ of execution (alimony, fines, compensation for damages, etc.).

- By order of the head - for violation of labor laws or in case of damage to property belonging to the organization.

- At the discretion of the employee himself - for non-cash payments when solving his social or domestic issues.

How are wages calculated? In order for the accruals to be accurate, and not approximate, the enterprise must have an approved management staffing and a time sheet must also be maintained.

Thirteenth salary

Most likely, every person at least once heard about 13 salaries. The thirteenth salary is an annual payment to an employee, which is formed from the total income of the organization based on the results of the year. Most often, it is accrued in the form of a promotion before the New Year. As a rule, such payments are usually called bonuses based on the results of the year, but among the people they called it the 13th salary, since the amount paid is usually equal to the average monthly salary.

How is 13 wages calculated? The accrual of such bonuses is not regulated by either the Labor Code or other Legislative acts. Accordingly, the process is carried out solely at the discretion of the employer. The amount and system of payment of 13 salaries is fixed in internal local documentation, for example, in the Regulation on bonuses or a collective agreement.

Because in Legislative acts 13 salary is not registered, the accounting department does not have the right to spend it as a wage. This payment is documented in the organization's local documentation as a bonus based on the results of the year or as an employee's remuneration, depending on qualifications. At the same time, if the thirteenth salary is calculated taking into account the company's profit for the calendar year, then:

- It cannot be calculated before the end of the year.

- Taxes and other deductions must be withheld from it, and this amount will be integrated into labor costs in accordance with Article 225 of the Tax Code of the Russian Federation.

The size of the thirteenth salary

How is 13 wages calculated? Each employer independently decides on the accrual of incentive payments based on the results of the year. As a rule, 13 salaries are paid to military personnel, civil servants and employees of large companies, the turnover of which makes it possible for managers to reward personnel.

The amount of the payment is set at the discretion of the administration, most often any percentage of the salary or the full amount of the average monthly wage is taken as the basis.

How is 13 wages calculated per year

Before calculating the specified payment, it is required to determine how it is spelled out according to the internal documentation of the organization. There may be several options:

- Bonuses for all staff based on the results of the year.

- Incentive pay to individual employees for good performance, such as increasing company profits.

- Award assigned to highly qualified specialists, and so on.

There are several options for calculating 13 salaries, these include:

- Definition of a fixed amount. Suitable in cases where the bonus is paid only to some employees.

- Establishment of a certain percentage or calculated coefficient of the amount of salary for the year. In this case, employees employed less than a year back, just like everyone else, will receive a full bonus.

- Accruals based on average annual earnings. This method is the most troublesome for the finance department, because it requires taking into account the time actually worked and the amount of payments for each month of the year for a specific employee. In this case, those who have worked for an incomplete calendar year will receive 13 salaries in the amount proportional to the hours worked. In addition, under this scheme, it is required to take into account an increase in salary if it was carried out in the current calendar year. That is, when the 13th salary is calculated according to the size of the bonus, which is ¼ of the salary, which has increased twice in a year, then in the current year its amount will be higher than in the previous one.

The conditions for calculating wages must be spelled out in the employment contract.

Twice a month - the minimum period for which the employee must transfer remuneration in connection with labor activity. Dates can be determined by management. The main thing is that the conditions for accrual are spelled out in detail in. The employer also determines how the settlement is carried out - in cash, or by bank transfers.

Separately, the form of the settlement sheet is approved. It describes various important aspects such as the calculation of allowances, deductions, and so on. Employers should tell their employees how to properly calculate salaries.

Wages are accrued from the very day a citizen officially gets a job. First, all the necessary information is provided to the personnel department, then the agreement is signed.

The contract will have to describe all important aspects of the agreement, including the payment of remuneration.

Payroll is carried out on the basis of a separate order issued by the director in detailed situations.

The order must contain the following information:

- Payment system used. It can be piecework or time-based, mixed.

- Indication of the time required for the provision of services, performance of work.

If an employee is fired, it must be recorded the exact date, When labor Relations stop.

About the legislative framework

Legislative regulation of payroll

Article 136 of the Labor Code of the Russian Federation regulates all issues related to accrual. And article 21 describes certain nuances associated with this direction. Both the entrepreneur and the employee should familiarize themselves with each of these pieces of legislation.

In addition, employee benefits are regulated by other additional documents:

- Decree of the Government of the Russian Federation No. 922. Determines the payroll procedure.

- Federal Law No. 306-FZ. Dedicated to payments for military personnel.

- Decree of the State Statistics Committee of the Russian Federation No. 1. To regulate the procedures for filling out paperwork.

- Federal Law "On accounting". From the name everything is clear.

Salary: accrual rules

The organization separately establishes the procedure by which remuneration for labor activity is calculated. The main thing is that the employee himself has studied the relevant rules in advance.

Worth considering:

- Tax transfers.

- Social, other types of similar payments.

- Rewards and penalties.

- System .

The employer must independently transfer insurance, pension fees.

There are the following factors that determine the correctness of the calculations:

- total earnings;

- due to study leave;

- due to plant downtime;

- due to forced absenteeism;

- due to the completion of training courses.

Each employee has the right to at least a minimum remuneration if he is officially employed and has a full time rate. This minimum is called the minimum wage. It depends on what the current living wage is.

Now in the regions the minimum wage is 7,800 rubles. For Moscow, it reaches almost 12,800 rubles.

There are two methods for calculating payroll:

- For actual hours worked.

- For the work done.

Any employee also has the right to receive an advance, for determining the amount of which the management is responsible. Salary and bonuses can be components of wages.

The time sheet is what you need to rely on when carrying out any types of calculations. This document is issued regardless of the system by which funds are issued.

Formula description, example

Payroll Formula

Piecework wages and salaries involve the use of various formulas.

Based on the formula will look like this:

ZPO \u003d part of the salary / number of working days for the period * number of days worked + bonus - personal income tax - withheld funds

The piece system has the following formula:

ZP \u003d piece rates * quantity of manufactured products + bonuses + surcharges - personal income tax - other deductions

Let's take the following conditions as an example:

- The employee has a 20,000 salary.

- The advance payment is made on the 11th day of each month.

- Basic salary is paid on the 3rd.

- It is necessary to determine the remuneration at the end of July.

- One month consists of 10 days off and 21 working days.

There are 7 working days left until the advance payment.

20 000 / 21 * 7 = 6667. We should receive such an amount on the first number.

Basic salary: 20,000/21*(21-7) = 13,333.

About the payment procedure

All employees receive two types of remuneration per month. One goes at the beginning, and got the name. The second is the final calculation, which has the function of wages.

The employer decides on what dates to issue money. It is on this particular day that all accruals should come. If the date falls on a weekend, the transaction is completed by the next working day at the latest. The main thing is to fulfill the requirements for the number of transfers.

Before the salary is issued, each employee is informed:

- Regarding the amount of payments, in general.

- On what deductions were made, in what amount.

- About all amounts transferred to the employee.

- About the components of the monthly rewards.

For accounting, statements are used with strictly established forms. The unified form No. T-49 (payroll statement) is widely used by employers. Or you may create your own versions of this document.

Accrued remuneration is transferred in cash or transferred to a bank account belonging to the employee.

Features of salaries on a business trip

Here they rely on such a concept as the average amount of earnings over time. When calculating, use the following formula:

SK = RDK x SZ.

SC - average earnings during a business trip.

RDK - working days that were spent on a business trip.

SZ - designation of the average earnings of an employee.

There is a separate formula for the SZ indicator.

SZ \u003d BASE / OD

Base - employee's income during the billing period.

OD - the number of days that were actually worked out.

The settlement period is standardly equal to 12 months that preceded the departure of a citizen on a business trip.

To calculate the OD indicator, use the formula:

OD = MONTH x 29.3 + ODNM/KDNM x 29.3

MES - how many full months were in the billing period.

ODNM - days worked for incomplete months.

KDNM - calendar days for incomplete months.

When the BASE indicator is calculated, vacation and sick leave payments and other types of similar calculations do not take part in the calculations. RDK is an indicator that involves taking into account how many days in total were spent on the road.

If an employee is on a business trip on weekends, one must rely on the so-called daily rates of each individual employee. It usually depends on which wage system is applied in principle.

Weekend days are also taken into account, during which the employee accurately performed his duties related to the business trip. It is necessary to pay not only standard wages, but also daily allowances.

Data sources for accruals

Timesheet is important primary document at the enterprise

The company is required to fill out timesheets daily. The following information should be reflected in the document:

- Work pass.

- The number of hours to work on holidays or.

- Night hours.

- Actual hours worked in one day.

Work may be missed due to weekends or holidays, illness, vacation.

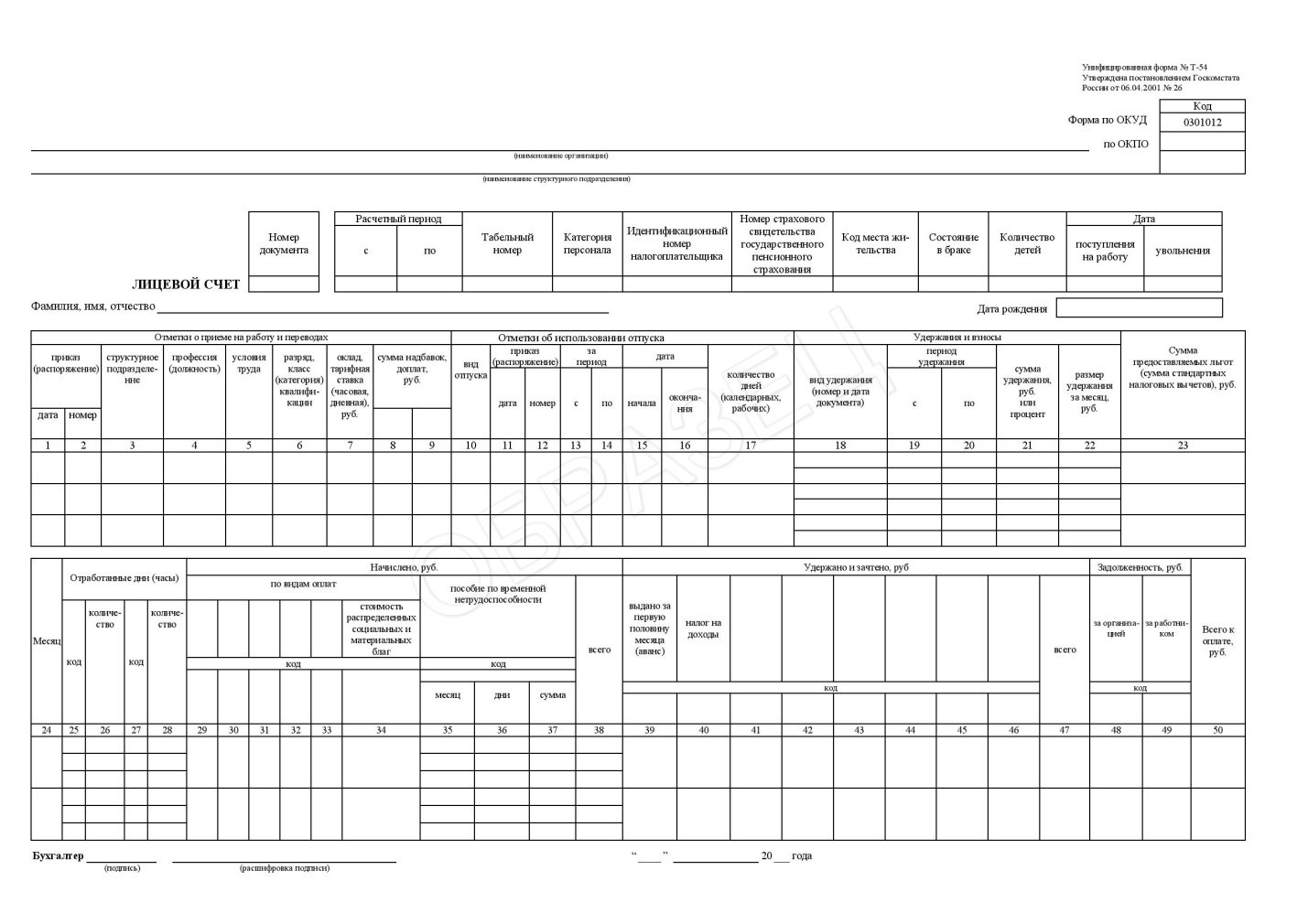

The time sheet (unified form No. T-13) is one of the main documents on which the correct determination of remuneration depends. A time sheet is a document that requires correct filling, the presence of all necessary details. For this, personal accounts of employees having the form No. T-54 are used.

Such papers are entered for each of the employees, starting from the moment of official employment. Personal accounts are filled throughout the whole calendar year. Documents are kept for 75 years.

The source of data on the income of employees can be:

- writ of execution,

- applications for tax deductions,

- financial assistance instructions

- bonus orders,

- sick leave,

- piecework outfits,

- time sheets.

The staffing table is used for those who are officially on salary.

Information for accrual under the piecework system

Includes information on salaries depending on what position a particular employee holds. In the case of piecework earnings, remuneration depends on how much work is done for a particular citizen.

The work performed, its volumes should be evaluated at the enterprise accordingly. But the management can independently decide which form of documents to use in practice.

Primary documentation may be as follows:

- Route sheets.

- Descriptions of outfits.

- Acts on the work performed.

Piece-rate wages are also used. The difference from the standard piecework scheme is the presence of additional premiums, fixed or percentage.

The indirect piecework form is often used by enterprises with auxiliary production.

This means that employees auxiliary industries receive a salary as a percentage of the remuneration that is paid in the main production.

Calculation of wages with a piecework wage system

The employer himself must set the so-called monthly norms, based on working hours and output. Piecework wages may be increased for those who exceed the specified norms.

For calculations, the output, or a proportional scale, is used.

Sometimes a regression scale becomes necessary. For example, when the exact fulfillment of indicators is more important, but not exceeding them. This is required in order to more carefully control the consumption, according to materials, raw materials.

About some features of taxation

First of all, salary is taxed standard personal income tax with rates of 13 and 30 percent for Russians and foreign citizens, respectively. Personal income tax is charged at the same moment when the salary itself is recognized as official income for a citizen.

It is necessary to keep the required amount at the time of payment. Taxes are transferred to the budget no later than the next day after settlements with the employee.

There are also mandatory contributions to various funds. They are applied with reduced or increased rates. The exact rules of application in a particular enterprise depend on the category.

The main thing is to calculate everything correctly, otherwise the rights of employees will be violated. It was precisely to prevent negative consequences that it was said that the employer must notify his workers of what parts the salary consists of, how much each of its components amounts to.

A printout for employees is compiled every month. Thanks to this, they themselves can check whether all operations are performed correctly.

Conclusion

When calculating wages, it is necessary to rely on what particular labor system operates in a particular enterprise. It can be piece-rate, time-based.

Which determines the formulas that are used most often in practice. A special procedure applies to the determination of remuneration for the duration of business trips.

It is important to pay attention to the payment of contributions. If they are violated, then the head will face additional punishment in the form of fines. It is better to consult with specialists in advance so that this issue can be resolved with minimal losses in money and effort.

From the video you will learn how you can easily calculate the salary:

Question form, write your

Payroll is one of the most time-consuming areas of accounting. Mistakes here can lead to the application of sanctions under several types of legislation at once. The situation is complicated by the fact that the regulatory framework is constantly changing. Consider how the rules for calculating salaries were changed in 2019 and what an accountant needs to know in order to avoid mistakes.

VAT and VAT

Let's start with a change that is known not only to accountants, but also to those who are far from accounting and economics in general. We are talking about an increase in the VAT rate from 01.01.2019 from 18% to 20%. It would seem - what does wages have to do with it? But this is only at first glance… The fact is that VAT can be considered a “wage” tax in a certain sense.

When a company sets a price for products, goods or services, it must cover all costs and make a profit. VAT is charged on all revenues, and only expenses subject to this tax are deductible. As a result, it turns out that the added value consists not only of profit, but also of non-taxable costs. And in their sum, the largest share is usually occupied by wages.

Although formally the VAT base has nothing to do with wages, in practice an increase in its level most often "automatically" leads to an increase in the burden of this tax. What kind of increase provides for a new procedure for calculating salaries - we will tell further.

Since 2019, a new mandatory payment has appeared in the Russian Federation - the professional income tax (PIT). In accordance with the law of November 27, 2018 No. 422-FZ "On the conduct of the experiment ..." this tax must be paid by the so-called self-employed citizens. These include those who receive income from self-employment (tutors, nannies, etc.).

This year, the experiment operates on the territory of four regions, but in the future it is planned to extend the effect of the NAP to the entire territory of the Russian Federation. It is possible that this will happen in 2020.

At first glance, this news also does not apply to payroll. However, employers “advanced” in terms of tax optimization quickly realized that paying VAT at a rate of 6% is much more profitable than personal income tax and insurance premiums. True, simply dismissing employees and then working with them as self-employed will not work - the legislator has provided for this. Payments under agreements between a legal entity and an individual are not subject to NAP if there have been labor relations between these persons over the past two years (clause 8, clause 2, article 6 of Law No. 422-FZ).

However, no one bothers to work in this way with new employees or open another entity and move staff there. With all these changes, the calculation of the salary in 2019 for "self-employed" workers will have to be carried out by the same accountants who deal with the "regular" salary. Therefore, we note once again that Law No. 422-FZ may be directly related to the activities of the organization and must be carefully studied for its correct application.

Insurance premiums

Now let's move on to mandatory payments, which directly depend on the level of payroll. We are talking about insurance premiums that are paid to off-budget funds. Here for taxpayers there is different news, both good and not so good.

Let's start with the positives. Previously, it was assumed that the general rate on contributions to the pension fund (22%) will be valid only until 2020, and then increase to 26%. This provision has now been abolished. Of course, nothing will stop the government from “changing its mind” again in a year or two, but today the pension rate of 22% can be considered valid indefinitely.

The cons relate to the "simplifiers". Until 2018 inclusive, many of them paid contributions at reduced rates. The total burden on these payments was not 30% of the payroll, as for "ordinary" businessmen, but ranged from 7.6% to 20%, depending on the category of the beneficiary (Article 427 of the Tax Code of the Russian Federation).

Now the list of beneficiaries on the simplified tax system has been significantly reduced.

The calculation of wages in 2019 with a benefit on insurance premiums was retained only for:

- IT companies (14%);

- NGOs social orientation (20%);

- residents of Skolkovo (14%) and special economic zones (7,6%).

Thus, for many former beneficiary organizations, new payroll rules came into force in 2019, which provide for an increase in the fiscal burden on businesses.

The standard annual change is to increase the marginal base for contributions to the PFR and the FSS. After exceeding the established limit, pension contributions are calculated at a reduced rate of 10%, and social contributions are no longer accrued at all.

For 2019, the calculation of wages in a new way provides for an increase in the "pension" base to 1,150,000 rubles, and the "social" base - up to 865,000 rubles.

Raising the minimum wage

Commercial organizations and individual entrepreneurs have the right to independently determine the level of remuneration of their employees. There is only one limitation - the minimum wage (SMIC).

Article 3 of the Law of December 28, 2017 No. 421-FZ “On Amendments ...” determines that from January 1, 2019, the minimum wage for each year should be equal to the subsistence minimum for the second quarter of the previous year.

Therefore, the monthly salary in the territory of the Russian Federation in 2019 cannot be lower than 11,280 rubles. (Order of the Ministry of Labor of the Russian Federation of August 24, 2018 No. 550n). It may include monthly bonuses and allowances established by the enterprise.

But the "northern" coefficients are not taken into account when compared with the minimum wage. Those. in this case, the basic amount of income should not be lower than the “minimum wage”.

The next increase in the minimum wage will be based on data for the second quarter of 2019. But the rules for calculating wages from July 2019 will not change.

The new “minimum salary” will come into force only from the beginning of 2020. In addition, regional authorities have the right to introduce their own minimum wage on the territory of a constituent entity of the Russian Federation. The main condition is that it should not be lower than the federal one.

Important!

In this case, all businessmen who have joined the regional agreement are required to pay salaries not less than the local minimum wage. For example, in Moscow in 2019 it is 18,781 rubles, and in St. Petersburg - 18,000 rubles.

Thus, the new formula for calculating wages should be applied by employers of each subject of the Russian Federation, taking into account the decisions of regional authorities.

Reporting changes

The new in payroll also affected related reporting.

First of all, it's all known reference 2-NDFL, with the help of which employers annually report on payments to employees and income tax amounts.

The document has become more detailed and now consists of two sheets - a breakdown of the employee's income by months is placed in separate application(Order of the Federal Tax Service of the Russian Federation dated 02.10.2018 No. MMV-7-11/566@).

In addition, a separate form of certificate has been introduced, which the employer issues to employees upon their request. 2-NDFL for employees consists of one sheet and is close in structure to the "old" report.

Also, since the new year, the forms of statistical reporting have traditionally changed. In particular, new forms have been introduced for the following reports related to wages and personnel (Rosstat order No. 485 dated 08/06/18):

- 1-T - working conditions;

- 3-F - salary delays;

- P-4 - number and wages;

- P-4 (NZ) - part-time employment.

The changes are mostly minor and technical in nature. An important point is the postponement of the deadline for submitting the annual form 1-T from January 19 to January 21.

Payroll deductions

Often, wages are collected from wages. various kinds employee debt. This can be alimony, loan debts, damages, etc. Since 2019, several innovations have also appeared in this area.

Now the recoverer can send the employer a writ of execution in the amount of up to 100 thousand rubles. Previously, this limit was significantly lower and amounted to 25 thousand rubles.

Important!

The Law of February 21, 2019 No. 12-FZ “On Amendments…” clarified a number of points related to limitations for collection. In particular, it is impossible to collect debts at the expense of funds received by citizens as material assistance in connection with emergency situations.

If the employer pays amounts that cannot be levied, then he must indicate in the documents the appropriate code for the type of income.

How to avoid mistakes

The calculation of employee benefits is associated with the need to take into account many nuances. The specialist who leads this site must understand not only accounting, but also personnel and civil law.

And if the accrual is carried out with errors, then the situation is aggravated by the fact that an incorrect operation can be repeated regularly, and the amount of distortion can grow from month to month and reach significant values.

However, today companies of different business sizes have a real opportunity to insure themselves against all sorts of accounting errors.

First of all, we are talking about automating all repetitive operations. In addition, the absence of errors is guaranteed by a multi-level control system:

- the chief accountant supervises accounting specialists;

- the curator controls the chief accountant;

- auditors and methodologists check the curator.

And in order to eliminate the human factor, all transactions are checked by the Electronic Auditor program - a unique development of 1C-WiseAdvice, which daily analyzes all customer bases according to specified algorithms for deviations from accounting standards.

If a discrepancy is found, it is automatically registered in the system. This allows specialists of all levels of control to see, analyze and eliminate the error, while developing tools to eliminate the likelihood of a recurrence of inconsistencies in the further work of specialists.

If the error was nevertheless missed, we bear full liability for its consequences, which is provided for by the exclusive insurance policy. This insurance document is designed in such a way as to guarantee full compensation for damages incurred by the client as a result of possible errors.

Order service

The calculation of wages at any commercial or state enterprise takes place in accordance with the legislative acts in force in this moment time. Its amount depends on the official salary prescribed in the employment contract, the hours worked during a certain period and other details. The amount due for payment is calculated by the accountant on the basis of a number of documents.

What is included in the calculation?

To date, two types of payment are most often practiced:

- Time . The first provides for a salary determined by the contract for the hours worked - an hour, a day, a month. Often a monthly rate is practiced. In this case, the total amount depends on the time worked during a certain period of time. It is mainly used in the calculation of salaries for employees who do not depend on the amount of the created product - accountants, teachers, managers.

- piecework . Depends on the amount of product created for a certain period. Often used in factories. It has several subspecies, which we will consider a little later.

Thus, time wages provide that the head of the enterprise or other official is required to maintain and fill out a time sheet. It is issued in the form No. T-13 and is filled out daily.

It should note:

- the number of working hours worked during the day;

- exits "at night" - from 22:00 to 6:00;

- out of hours (weekends, holidays);

- omissions due to various circumstances.

Piecework payment provides for the presence of a route map or an order for a certain amount of work. In addition, the following are taken into account: sick leave, orders for bonuses, orders for the issuance of material assistance.

After hiring, each accountant must keep an analytical record of wages and record it in the form No. T-54. This is the so-called personal account of the employee. The data specified in it will be taken into account when calculating hospital payments, vacation and other types of benefits.

You can find out how vacation pay is calculated.

Calculation formula and examples

Hourly pay provides for remuneration according to the time worked and the salary of the employee.

It is calculated as follows:

For monthly salary:

ZP \u003d O * CODE / KD, where

- O - fixed monthly salary;

- CODE - days worked;

- CD is the number of days in a month.

For hourly/daily fixed salary:

ZP \u003d KOV * O, where

- ZP - wages excluding taxes;

- KOV - the amount of hours worked;

- O - salary per unit of time.

Consider an example:

Tatyana Ivanovna has a monthly salary of 15,000 rubles. There were 21 working days in a month, but since she took a vacation at her own expense, she worked only 15 days. In this regard, she will be paid the following amount:

15,000*(15/21)=15,000*0.71= 10,714 rubles 30 kopecks.

Second example:

Oksana Viktorovna works with a daily salary of 670 rubles. This month she worked 19 days. Her salary will be:

670 * 19 \u003d 12,730 rubles.

As you can see, the formula for calculating wages for this type of payment is very simple.

Piecework payment - how to calculate?

With piecework wages, the amount of work performed is paid. At the same time, prices are taken into account in the ratio of the volume of work.

With piecework wages, wages are calculated according to the following formula:

ZP \u003d RI * CT, where

- RI - prices for the manufacture of one unit;

- CT - the number of products produced.

Consider the following example:

Ivan Ivanovich produced 100 engines in a month. The cost of one engine is 256 rubles. Thus, in a month he earned:

100 * 256 \u003d 25,600 rubles.

piece-progressive

It is worth considering separately such a type of payment as piecework-progressive, in which the price depends on the number of products produced for a certain period.

For example, if an employee produces 100 engines per month, then he receives 256 rubles for each. If it exceeds this norm, that is, it produces more than 100 engines per month, the cost of each engine produced in excess of the norm is already 300 rubles.

In this case, earnings for the first 100 engines and separately for subsequent ones are considered separately. The amounts received are cumulative.

For example:

Ivan Ivanovich made 105 engines. His earnings were:

(100*256)+(5*300)=25,600+1,500= 28,100 rubles.

Other payment systems and their calculation

Depending on the specifics of the work, payment can be:

- chord . Often used when paying for the work of the brigade. In this case, the salary of the brigade as a whole is calculated and issued to the foreman. The workers divide the amount received among themselves according to the agreement existing in their brigade.

- Payment based on bonuses or interest . A bonus or commission system is applied to employees on whom the company's revenue depends (see also). Quite often it is applied to sales consultants, managers. There is a constant, fixed rate and a percentage of sales.

- shift work . The shift method of work provides for payment according to the employment contract - that is, by the time or for the amount of work performed. In this case, there may be interest allowances for difficult working conditions. For exits on non-working days, holidays, payment is calculated in the amount of at least one daily or hourly rate on top of the salary. In addition, an allowance is paid for the shift method of work from 30% to 75% of the monthly salary. The interest rate depends on the region in which the work takes place. For example, Ivan Petrovich works on a rotational basis. His monthly rate is 12,000 rubles, the allowance for work in this region is 50% of the salary (O). Thus, his salary will be 12,000 + 50% O \u003d 12,000 + 6,000 \u003d 18,000 rubles per month of work.

Payment for holidays and night shifts

When working in shifts, each shift is paid depending on tariff rate every shift. It is either installed employment contract or calculated by an accountant.

At the same time, it should be borne in mind that weekends and holidays are paid at a higher rate - an increase in the rate by 20%. In addition, exits at night from 22:00 to 06:00 are also subject to a rate increase of 20% of the cost of an hour of work.

payroll taxes

When calculating wages, do not forget about taxes. Thus, the employer is obliged to pay 30% of the amount of calculated wages to the insurance premium fund.

In addition, employees are charged 13% of their wages in personal income tax. Let's take a look at how taxes are calculated.

First of all, the tax is charged on the entire amount of wages, except for cases in which there is a tax deduction. So, a tax deduction is calculated from the total amount of wages, and only then the tax rate is calculated on the resulting value.

The right to a tax deduction has a number of socially unprotected categories, the list of which is prescribed in article 218 of the Tax Code of the Russian Federation. These include:

- Veterans of the Great Patriotic War, invalids, whose activities were connected with nuclear power plants. The tax deduction is 3000 rubles.

- Disabled people, participants of the Second World War, military personnel - 500 rubles.

- Parents who are dependent on one or two children - 1,400 rubles.

- Parents who are dependent on three or more children - 3,000 rubles.

The last two categories are restricted. So, after the amount of wages received from the beginning of the calendar year reaches 280,000 rubles, the tax deduction is not applied until the beginning of the next calendar year.

Example:

Ivan Ivanovich's monthly salary was 14,000 rubles, since he worked for a full month. He received a disability while working at a nuclear power plant. Thus, his tax deduction will be 3,000 rubles.

The personal income tax is calculated for him as follows:

(14,000 - 3,000) * 0.13 = 1430 rubles. This is the amount that must be withheld when receiving wages.

Thus, he will receive in his hands: 14,000 - 1430 \u003d 12,570 rubles.

Second example:

Alla Petrovna is the mother of two minor children. Her salary is 26,000 per month. By December, the total amount of wages paid to her will be 286,000 rubles, therefore, no tax deduction will be applied to her.

Payment procedure and calculation of delays

According to all the same legislation, wages must be paid at least 2 times a month. Allocate an advance, which is issued in the middle of the month and the actual salary.

The advance payment averages from 40 to 50% of the total amount of payments, at the end of the month the rest of the payments are issued. Usually this is the last day of the month, if it falls on a weekend - the last working day of the month. In case of untimely calculation of wages, the employer is obliged to pay a fine.

In addition, compensation is provided for the employee, which is issued at his request and amounts to 1/300 of the rate for each day of delay.

Video: Simple payroll

Familiarize yourself with the basic nuances of calculating and calculating wages. An experienced accountant will tell you how to correctly calculate wages, depending on the wage system you choose.

The calculation of wages is made by an accountant on the basis of a number of documents. There are two main systems of remuneration: piecework and time. The most popular is the time-based wage system - it is quite simple and is used in most industries.

Today we will consolidate the information written earlier in practice, consider an example of payroll.

Payroll Example

There are five employees at our enterprise, it is necessary to calculate and calculate their salary, for example, for the month of May, in which there are 21 working days.

To calculate wages, we need data on the salary established for each employee, personal income tax deductions due to them and the number of days worked in May. In addition, information on the total salary accrued since the beginning of the year will be useful.

Employee data: (click to expand)

Last name of the worker | Salary | Deductions | Number of days worked in May |

| 70000 | 2 children | ||

| 20000 | 500 rubles, 1 child | ||

Nikiforov | 24000 | 3000 rubles, 2 children | |

| 16000 | 2 children | ||

| 16000 | 500 rubles, no children |

Starting from the beginning of the year until the month of May, all employees worked all the months in full, we will take the regional coefficient in our example of calculating wages equal to 15%. Let me remind you that data on the days worked are taken from the time sheet, a sample of this document can be found.

Consider the first worker Ivanov.

1) We determine the salary for the hours worked

In May, he worked 20 days out of the required 21.

Salary for hours worked is defined as Salary * Days worked / 21 = 70000 *

Ivanov received a salary = 70,000 * 20 / 21 = 66,667 rubles.

2) Determine the required deductions

Since the beginning of the year, he has been paid a salary of 322,000 rubles, so he is no longer entitled to deductions for children. Let me remind you that children's deductions are valid until the employee's salary, calculated from the beginning of the calendar year, has reached 280,000 rubles.

3) We calculate wages taking into account the regional coefficient

Salary \u003d 66667 + 66667 * 15% \u003d 76667 rubles.

4) We consider personal income tax

Personal income tax \u003d (Acrued salary - Deductions) * 13% \u003d (76667 - 0) * 13% \u003d 9967 rubles.

5) We calculate the salary that we will pay to the employee:

Salary payable \u003d Accrued salary - personal income tax \u003d 76667 - 9967 \u003d 66700 rubles.

Similarly, calculations are made for all other employees.

All calculations for the calculation and payroll for all five employees are summarized in the table below: (click to expand)

| Full name | Salary since the beginning of the year | Salary | Otrab. days in May | Salary for work time | accrued salary | Deductions | Personal income tax (Salary - Deductions) * 13% | To payoff |

Ivanov | 322000 | 70000 | 20 | 66667 | 76667 | 0 | 9967 | 66700 |

Petrov | 92000 | 20000 | 21 | 20000 | 23000 | 1900 | 2743 | 20257 |

Nikiforov | 110400 | 24000 | 21 | 24000 | 27600 | 5800 | 2834 | 24766 |

Burkov | 73600 | 16000 | 21 | 16000 | 18400 | 2800 | 2028 | 16372 |

Krainov | 73600 | 16000 | 10 | 7619 | 8762 | 500 | 1074 | 7688 |

Total | 154429 | 18646 | 135783 |

In practice, when calculating and calculating salaries, a primary document is filled out - a payroll form T51, a sample of which can be downloaded.

Based on the results of the calculations, the total amount of the accrued salary, and the salary intended for payment, is considered.

Calculation of insurance premiums

In the following articles, we will consider how vacation pay is calculated at the enterprise and give examples of calculation.

Video lesson “The procedure for paying wages to employees of the organization”

Video lesson from the teacher of the training center “Accounting and tax accounting for dummies”, chief accountant Gandeva N.V. Click below to watch the video ⇓