How to find out about debts and where you can check them

With every profit received, a Russian citizen is obliged to pay taxes. They can be of several types, but all are subject to redemption. It is also mandatory to pay any resulting fines that may arise due to administrative violations.

If bills are not paid on time, debt may arise. How to find out the tax debt of an individual will be described below.

Debt is a certain amount of money that must be paid. It can arise between two firms or people, between a person and a store, a bank, an insurance company or the state. most often, the financial problems of the debtor become: the amount of the loan or payment not paid on time leads to the emergence of debts.

Depending on the parameters of the debt are divided into several options:

- General division of debt:

- Accounts receivable - someone owes money to the subject;

- Creditor - the subject owes money to someone.

- Causes of debt, to whom the debt arose:

- To suppliers of goods or services;

- Before banks or credit organizations;

- Before the state (payment of taxes);

- Organizations may incur debts to employees.

- By timing:

- Current debt - the payment of funds is planned during the current financial year;

- Long-term - repayment will not occur earlier than next year.

- Upon receipt of payment:

- Normal - payment occurs on time;

- Overdue - payment was not received on time.

How to find out tax debts on the website of the Federal Tax Service, see this video:

Dear readers! Our articles talk about typical ways to deal with legal debt issues, but each case is unique.

If you want to know how to solve exactly your problem - contact the online consultant form on the right or call +7 (499) 703-51-68. It's fast and free!

tax debts

Debts of individuals are most often associated with taxes. This includes taxes on:

- Income: they are paid from salaries, prizes, royalties, inheritances, gifts and other income received;

- Property (apartment, house, cottage) and land (if any);

- Transport.

A tax debt arises when the tax is not paid on time. The reasons may be:

- Incorrectly calculated amount;

- Error filling out the receipt;

- Late payment;

- Non-payment of a separate tax due to ignorance: most often the transport tax or inheritance tax “suffers”;

- Tax department error.

Punishment for violations

Tax arrears result in interest charges. If the debts are not paid within the next few days, the state can go to court. After that, the citizen will either have to pay a fairly large fine (up to half a million rubles), or spend up to 3 years in prison.

The amount of the fine depends on the reasons for non-payment:

- If the failure occurred by accident (for example, due to an error when filling out a receipt or incorrect calculation), a fine of 20% of the tax amount will be imposed on the citizen;

- If non-payment occurred intentionally or a second time (of course, this must be proven), then the fine will be 40%.

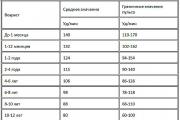

Penalties are accrued daily and amount to 1/300 of the Central Bank refinancing rate. To find out the amount of debt, you must use the formula:

Penalty amount = A * B * C * 1/300, where

A - overdue amount of tax,

B - the number of days overdue,

C is the refinancing rate.

After the resulting number must be added to the total debt.

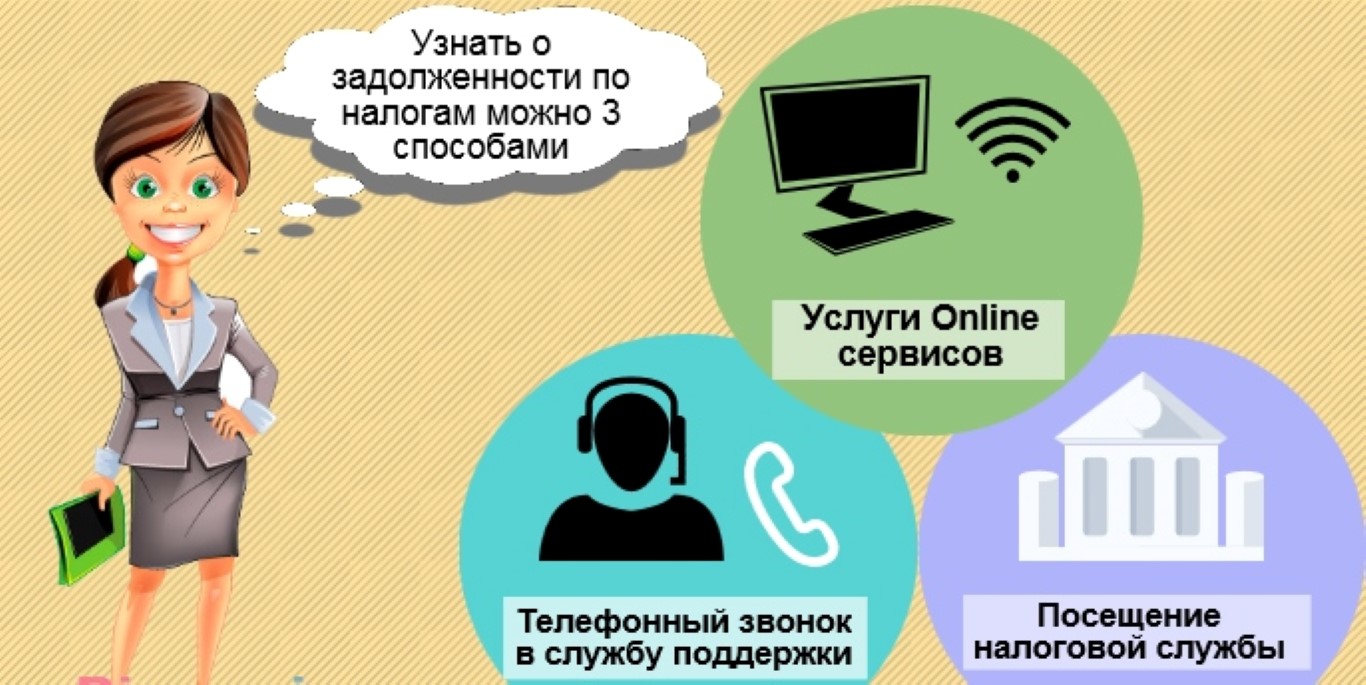

How can you find out the debt?

How to find out about debts and where you can check them

Find the answer to the question "How do I find out my tax debts?" possible in different ways.

Through the tax, how is the check

You can find out the tax debt by arriving there in person. To do this, you will need to take your passport and TIN number with you. The advantages of this method include the ability to immediately learn about the debt, its causes, as well as ask all your questions.

In addition, you do not have to register on the IFTS website - you can find out the debt right away. The disadvantages include the need to allocate time to get to the place.

Through the official website of the tax

You can find out about the availability either on the official website of the tax service or through the website of the Federal Tax Service. This option has many advantages:

- Through your personal account, you can not only check the debt, but also find out about overpayments, future payments, terms and what taxes you need to pay;

- Print the necessary receipts;

- Pay debts online using an electronic wallet or bank card;

- Fill out an online tax return and submit it.

To find out the debt through the Federal Tax Service, you will need to go to their website - “Your Debt”, however, this can only be done through your personal account. You can access your personal account in one of three ways:

- Get in the tax personal login and password. To do this, you need to drive to the territorial office with a passport and a copy of the TIN and get it;

- You can register a personal account of a taxpayer of an individual and find out the debt using an electronic signature or a Universal Electronic Card;

- If you have registered on the State Services portal, you can apply an account from there.

After entering your personal account, you will need to enter your full name and TIN number, then select the region. The site will remember all the data, you will not have to enter them next time. But the password will have to be changed within a month - after it will become invalid. After the search, the tax office will select all tax debts and unpaid fines. They can be paid immediately.

Through Public Services

Checking debts is also possible through the State Services portal, but this will also require registration. This can be done in two ways:

- Fill out the form and wait for the data to be confirmed - this may take several days. Then the login and password for login will be sent by mail;

- Use the electronic signature and wait for identity confirmation.

After that, checking the debt will take no more than a couple of minutes: it will be enough to go to "Popular services" - "Tax debt". The State Services Portal can also be useful after: find out the transport tax or overpayments, apply for documents or a visa.

Through the FSSP website

Website of the Federal Bailiffs Service. Here you can check debts without registration: you just need to enter the full name of the person of interest and select the region. After the search, the site will display a list of people with similar data, from which you will need to select the right one.

What data is needed to find out the debt?

More detailed information can be obtained by contacting the bailiffs personally. On the site, you can also not only check the debt, but also immediately pay it.

The only drawback of such a system is the duration of deleting information from the database: after that, the data from the site will disappear only after 3-7 days. In addition, data will only be displayed for debts that have already been submitted to the court and are being litigated.

Through Yandex-Money

This method may raise some doubts, but it works great and does not require registration.

- You need to go to "Yandex-Money";

- Select "Taxes";

- Enter the TIN number.

How to quickly pay off tax debts, this video will tell:

After that, the system will find all unpaid receipts and display a list on the screen. The same method can be used to find out about existing car fines: for this, instead of "Taxes", you must select "Fine" and enter the numbers of the driver's license and vehicle registration certificate.

A little about transport tax

This tax belongs to the regional ones, it is paid by all owners of vehicles: cars, motorcycles, buses, airplanes, motor ships, etc.

Its amount depends on the number of horsepower: the more powerful the transport, the more expensive each “horse” will cost. The final amount is subtracted by multiplying the amount of horsepower by a specific rate - it also depends on the power of the motor.

You can check the transport tax in any of the above ways. However, since the TIN is used in the search, then the data search will be carried out by person, and not by car.

You can find out the debt for taxes or fines using one of the above methods. These methods are the most reliable and will help you find out the exact information. It is not recommended to use other sites and portals, and you should not pay for anything through them.